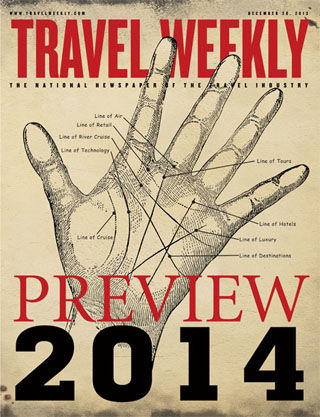

Preview 2014

Travel Weekly's Editor in Chief Arnie Weissmann spoke to executives about their outlook for 2014. Click here to read.

In addition, columnist Richard Turen offers up his predictions for 2014 here.

And Travel Weekly's staff writers looked ahead to 2014 in several industry sectors:

The ingredients are in place for the travel industry to have a year of growth and prosperity in 2014. Demand is strong, the economy is improving, and the major supplier categories are beginning the year with their houses pretty much in order.

With the consummation of the American-US Airways merger, the airline industry is getting reacquainted with profitability and is poised to push on. The cruise industry, buffeted by disasters and breakdowns in 2012 and 2013, is finally seeing the bad publicity recede.

Hotels and resorts, buoyed by rising rates and occupancies, continue to attract both guests and investors. The car rental industry, also firmed up by consolidation, is making itself more accessible every day. And tour and river cruise companies are beginning the year with momentum and product lines tweaked by innovation.

A quick scan of leading indicators suggests that, barring external disruptions, the economic environment will be good enough for every mode to do well. It even looks like the federal government might behave itself in 2014, sparing us the jolts of sequestration and shutdowns.

The recession knocked a lot of our abbreviations and acronyms on their ears: GDP, Nasdaq, etc. Most distressing for millions of workers, the typical IRA and 401(k) took a hit too. Most of these have regained their lost ground and some — the market indexes, for example — have picked up new momentum.

But early on, many experts honed in on two big data points that, more than any other, would tell the tale of this recovery: unemployment and housing. Both have been particularly stubborn, but as 2013 comes to a close there are signs that even these two laggards are finally getting traction.

According to the Bureau of Labor Statistics, the national unemployment rate dropped another notch, to 7%, in November, a level not seen since the index crossed that line on its way north in December 2008. The average work week and hourly wage are also trending up.

According to the Bureau of Labor Statistics, the national unemployment rate dropped another notch, to 7%, in November, a level not seen since the index crossed that line on its way north in December 2008. The average work week and hourly wage are also trending up.

For 2014, the Federal Reserve is forecasting a continued drop in the unemployment rate, possibly to as low as 6.4%. Although the trend has been slow because of pockets of high unemployment in particular geographic areas and among certain demographic groups, the overall trend has been pronounced and positive.

On the housing front, there are still far too many homeowners dealing with foreclosure, and far too many homeowners are underwater on their mortgage (i.e., they owe more than the property is worth), but the tide has turned.

The National Association of Home Builders reported earlier this month that in 54 of the nation’s 350 metropolitan areas, activity in the housing market is at or above normal levels, based on an algorithm that factors in housing permits, home prices and employment levels.

More than a third of the metro markets were at 90% of normal, and overall the national housing market is running at 86% of normal, the association said.

October data from the Department of Housing and Urban Development put the number of underwater borrowers at 7.1 million, down from 10.8 million a year earlier. New foreclosure actions were down by a third.

The housing market and housing prices are particularly important markers because home equity is a major contributor to total household net worth and to many families’ sense of security and, consequently, their willingness to spend.

Notably, household net worth as measured by the Federal Reserve reached pre-recession levels in 2012, and total household equity in real estate, after sliding to $6.2 trillion in 2011, approached $9.7 trillion in this year’s third quarter.

Against this backdrop, optimism seems appropriate, and the airlines are apparently eager to oblige. IATA has forecast a 31% increase in global airline passengers during the five-year period between 2012 and 2017, which translates to nearly a billion new air travelers.

For the American travel market next year, the U.S. Travel Association is forecasting a 5% increase in total travel expenditures, to $940 billion, with $151 billion of that coming from a record 73.4 million international visitors.

This could go well. Unless something goes wrong.